TurboTax is a quick and efficient choice for last-minute tax filers. From the simple to complicated tax returns for first timers or experienced filers. Organizing tax information and guiding through the process of federal and state tax returns.

Although expensive compared to other online tax filing services, its ease of use and customer support helps TurboTax stand out from competitors.

Its efficient question-and-answer process and extensive tax expertise allows you to file your tax return correctly whilst getting the maximum eligble tax refund.

The only downside apart form the price is the frequent prompts to buy upgrades or extra features.

What do you need to know about TurboTax?

- Who should use TurboTax – From experienced tax preparers to first timers with little knowledge.

- TurboTax Pricing – Ideal for DIY taxes. Live assistance is unnecessary. Full Service is costly.

- TurboTax Ease of Use – Very easy to use, with interview style interface, progress and estimation gauges.

- TurboTax compared to the competition – Not the cheapest and competitor offer similar services for less.

- Other features – TurboTax supports Crypto businesses, do taxes on the go and upload tax info via photos.

1. Who Should Use TurboTax?

From Experienced tax preparers to First Timers with little knowledge.

Overview

Turbotax is for everyone, from experienced tax preparers to first timers with little knowledge of tax processes.

Making tax filing easy with interview-style questions that walks you through the filing process. And further options for live, on-screen support if needed.

With alot fo ways to file your taxes like hiring a CPA, using third-party software or using one of the IRS’s Free File Online partners. TurboTax really makes the process easier for most tax situations.

Highlights

- For students and filers with a simple return, which usually contains a single W-2 from one employer, doesn’t include investment income or rental property.

- For those with investment income and rental property. Also a great option for those with robust cryptocurrency activity.

- For self-employed, gig workers, freelancers, contractors and small business owners with investment income and rental property income. Even a salaried worker having done freelance work.

Note

- If you have a more complicated tax situation. Like a self-employed worker with multiple clients or side hustles, TurboTax’s business packages may be more expensive than others.

- If you worked in multiple US states and need to file separate state tax returns. Jackson Hewitt is better, charging $25 and includes free, unlimited state returns when you file a federal return.

- For claiming qualified disaster retirement plan distributions the required IRS Form 8915-F is available to file via TurboTax since March 24, 2022.

- Others like Form 4972, Tax on Lump Sum Distributions, are ready since March 31.

- Check to see all the IRS forms that TurboTax supports and available dates for e-filing.

Bottom line

Anyone can use Turbotax. It’s for everyone, from experienced tax preparers to first timers with little knowledge of tax processes.

2. TurboTax Pricing

Ideal for DIY taxes. Live assistance is unnecessary. Full Service is costly.

Overview

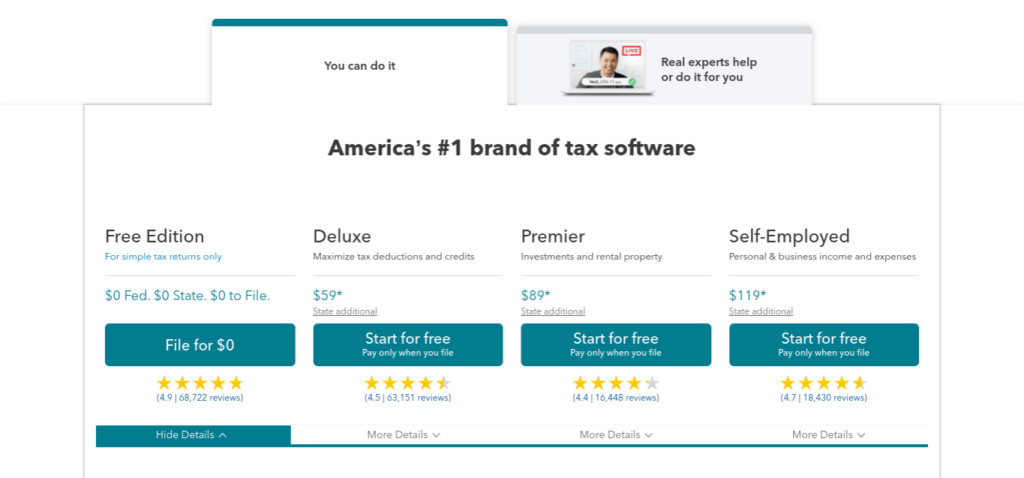

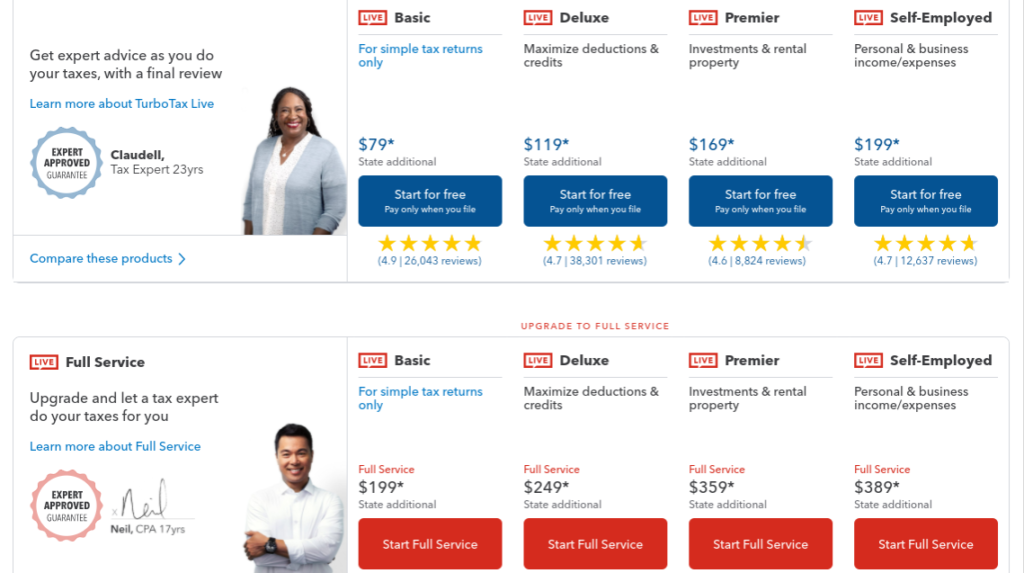

TurboTax offers four different products, Basic, Deluxe, Premier and Self-Employed, depending on how complex your return is and how much help you need.

Basically filing your own with step-by-step guidance. Help, advice and a review from a tax expert with your taxes. And a tax expert to prepare, sign and file your tax returns.

TurboTax Live offers expert consulation who reviews your return and Full Service offers an expert to prepare and file your return.

Highlights

- Basic: For filers with simple returns that don’t require multiple itemized deductions. Can claim earned income tax credit, student loan interest and all or the rest of the child tax credit. If receiving unemployment benefits, pay for Deluxe edition. Free.

- $79 for TurboTax Live

- $199 for Full Service.

- Deluxe: For maximizing deductions and credits. If not eligible for any credits or deductions, check if maximizing your refund is worth it. You will the process over if you go to a lower tier. $39 for federal return and $39 for each state return.

- TurboTax Live: $119 for federal returns and $49 for each state return.

- Full Service: $249 plus $49 for each state return.

- Premier: For complicated returns like investments and real estate income while maximizing your refund. $69 for federal returns plus $39 for each state return.

- TurboTax Live: $169 for federal returns plus $49 for each state returns.

- Full Service: $359 plus $49 for each state return.

- Self-Employed: To maximize deductions and report personal and business income and expenses. Plus any part-time freelancers need this edition to report income and maximize deductions. $89 for federal return plus $39 for state returns.

- TurboTax Live: $199 for federal taxes and $49 per state.

- Full Service: $389 for federal taxes and $49 per state.

Note

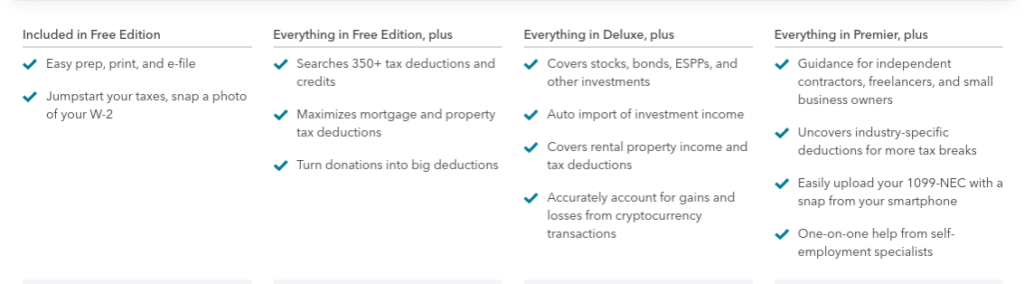

Free Version:

- FOR: Simple tax returns like filing a Form 1040, claim the earned income tax credit, reconcile your advanced child tax credits and deduct student loan interest.

- NOT FOR: Unemployment income reported on a 1099-G, itemized deductions or schedules 1, 2 or 3 of Form 1040 and deducting mortgage interest, report business or freelance income, or report stock sales or income from a rental property.

Bottom line

TurboTax is ideal for DIY taxes with resources answering any tax questions you have. Live assistance is unnecessary and the Full Service is costly compared to a local CPA.

3. TurboTax Ease of Use

Very easy to use, with interview style interface, progress and estimation gauges.

Overview

Tax returns on TurboTax go through the tax preparation and filing process in a similar way that a tax preparer would. With single taxpayer related process taking around 13 minutes.

Married couple filing related process taking roughly 20 minutes and self-employment income, federal and state estimated tax payments taking about 30 minutes.

Tracking your progress and highlighting areas you need to complete. With tips, explainers and resources. And help buttons for on-screen help and more.

Highlights

- Interface: Easy to use interface with interview style questions much like a tax preparer.

- Progress: A section at the side tracks progress and highlights uncompleted areas.

- Estimation: A section at the top of the screen keeps track of your estimated federal and state refund or amount due.

- Upgrade: An additional fee to upgrade to TurboTax Live and get on-demand help from a TurboTax expert or CPA. Also offering a final review before you file.

- Full Service: An additional fee to have your tax return prepared and a scheduled time to review your return before filing.

Note

- TurboTax offers many tips to help do your tax return yourself, including the TurboTax Digital Assistant. But not hands-on customer service unless you upgrade to TurboTax Live.

Bottom line

TurboTax is very easy to use, with features such as interview style interface, progress and estimation guages which helps you through the process until completion.

4. TurboTax compared to the Competition

Not the cheapest and competitor offer similar services for less.

Overview

With competitors such as TaxSlayer charging up to $59.95 for federal tax filing and TurboTax charging up to $119. And TaxSlayer an additional $39.95 per state when TurboTax charges $49. All for similar DIY tax packages.

For a TurboTax expert or CPA to prepare, sign, and file your taxes it costs up to $389 for federal tax filing and an additional $54 per state. A local tax preparer or CPA could be cheaper.

Highlights

- TAXACT: Federal – $46.95 to $94.95. State – $39.95 to $54.95. Free version available for simple tax returns only.

- H&R BLOCK: Federal – $49.99 to $109.99. State – $0 to $44.99 per state. Online Assist add-on gets you on-demand tax help. Free version available for simple tax returns only.

- TURBOTAX: Federal – $59 to $119. State – $0 to $49 per state. TurboTax Live packages offer review with a tax expert. Free version available for simple returns only.

- TAXSLAYER: Federal – $29.95 to $59.95. State – $0 to $39.95 per state. On-demand tax help at Premium and Self-Employed tiers. Free version available for simple tax returns only.

Note

Other competitors offer tax expert assistance:

- TaxAct provides professional tax expert assistance, including help from CPAs, Enrolled Agents (EAs) and tax attorneys to help with filing for FREE.

- TaxSlayer Premium or Self Employed version, offer tax assistance, limited to guidance only.

Bottom line

TurboTax is not the cheapest on the market and you will find competitor tax filing softwares offering similar packaged services for less.

5. Other features

Supports Crypto businesses, do taxes on the go and upload tax info via photos.

Overview

TurboTax’s desktop app and mobile app make it easy to input information and upload tax documents. Allowing you upload documents from previous years or from other tax services, even taking photos of physical documents. You can pause the process on one device resume on another.

Other useful tools include a charitable donation calculator and a refund estimator consistently updating figures. Information is provided to help you answer difficult tax questions with simple responses with context.

Highlights

- Switching providers: Import electronic PDFs, not scans of hard copies, of tax returns from H&R Block, Credit Karma, Liberty Tax, TaxAct and TaxSlayer.

- Auto-import tax documents: Automatically import W-2 information from employers partnered with TurboTax, also upload your W-2 data via photo to your return. Import certain 1099s, and Self-Employed version also upload 1099-NECs from clients via photo, and import income and expenses from Square, Uber and Lyft.

- Crypto support: TurboTax’s Premier package eliminates manual entry. Users can import up to 4,000 transactions at once.

- Donation calculator: The Deluxe, Premier and Self-Employed packages integrate ItsDeductible, a feature and standalone mobile app for quickly finding the deduction value of donated clothes, household items and other objects.

- Platform: Access and work on your return on your computer via the website or on your phone or tablet.

Note

- Free audit support from a tax pro and if TurboTax can’t connect you with a pro, you get a refund.

- For represention in front of the IRS, TurboTax’s MAX is an audit defense product at $49 and includes identity theft monitoring, loss insurance and restoration help.

- Choose to receive refunds as Directly Deposited in your Bank, Turbo Visa Debit Card or Coinbase account. Also Paper check, refunded to next year’s taxes, buy U.S. Savings Bonds by the IRS or pay TurboTax charges but with a charge.

Bottom line

TurboTax standout features support crypto businesses, allow you to do your taxes on the go and uploading tax information quickly via photos.

Free plan vs Paid plan on TurboTax

If you are doing your tax returns yourself with the Free plan, TurboTax offers searchable information, forums, video tutorials and a Digital Assistant.

For paid access TurboTax specialists offer unlimited tax advice and review your returns or get your tax returns done for you by uploading documents and a tax preparer does the rest.

Wrap up.

TurboTax is ideal for doing your taxes yourself. Although its expensive, the design, smooth process plus its product range and support options make it worth the price.

You might find competitors are cheaper and offer similar features. But to get your taxes done quickly and with little headache, pick TurboTax.