When you hear crypto coin market cap, its not something industry experts only know or an insider term. The market cap or market capitalization is simply the total value of all the mined coins.

In crypto, its calculated by taking the total number of mined coins and multiplying it by the price of a single coin. It’s a helpful indication for determining how stable a digital asset is.

A larger market cap is likely to be a stable investment compared to a smaller market cap which is more likely to have huge ups or downs.

Lets learn more about market cap.

What you need to know about Coin Market Cap?

- What is a Good Market Cap for a Coin? Large-cap Cryptocurrencies are considered safer investments.

- Why Market Cap IS Important? It indicate growth potential and if it’s a safe buy, compared to others.

- Why Market Cap is NOT Important? Use Metcalfe’s Law, market liquidity & monthly volume metrics too.

- What happens when a Coin reaches Maximum Supply? More earnings from transactions versus mining.

- Is it better to invest in Large-Cap or Small-Cap Coins? Large-cap investing is safe & small-cap is risky.

1. What is a Good Market Cap for a Coin?

Large-cap Cryptocurrencies are considered safer investments.

Overview

Now that you know what market cap means, lets discuss what a good market cap is. Generally, the bigger the market cap of a company the more stable the investment.

Tradionally in stocks investors use market capitalization to help them know where to invest and how risky the investment is.

With cryptocurrency markets, people are starting to look at market caps too. But crypto being mostly unregulated, look at other factors aswell to determine risk.

Highlights

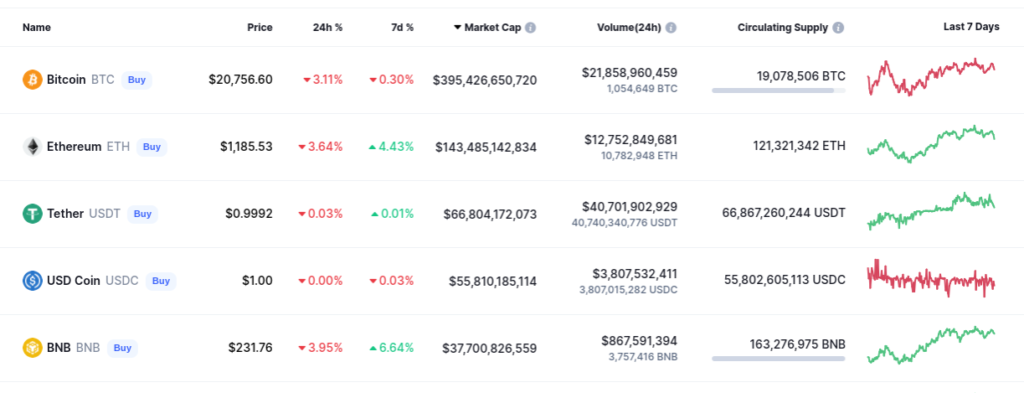

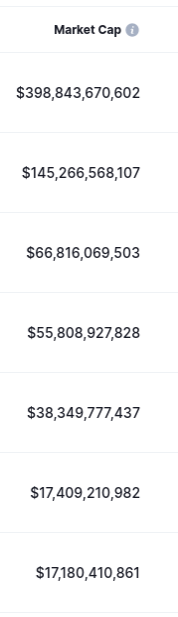

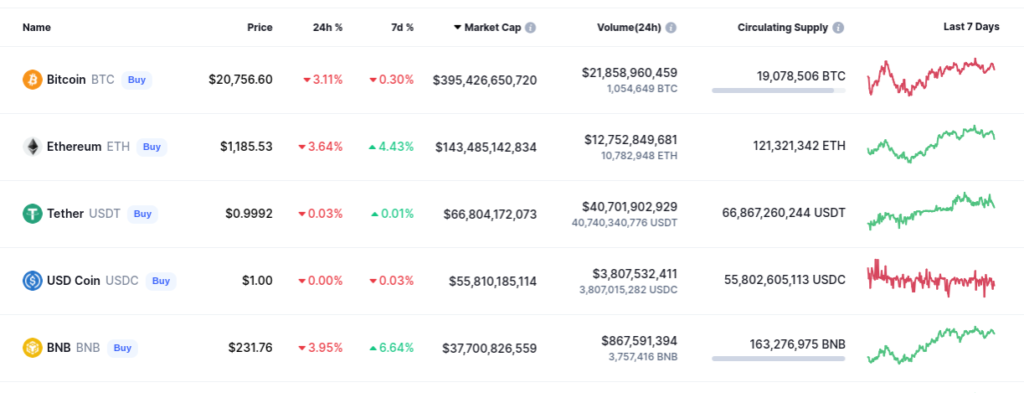

- Bitcoin, a decentralized cryptocurrency originally described in a 2008 whitepaper by the alias Satoshi Nakamoto. Market cap: $402,429,871,129.

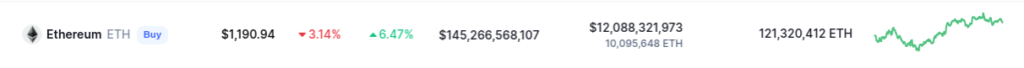

- Ethereum, a decentralized open-source blockchain system with its own crypto, Ether. Crypto and smart contracts. Market cap: $146,090,477,163.

- Tether is a stablecoin mirroring the price of the U.S. dollar, issued by a Hong Kong-based company. Market cap: $66,928,550,682.

- USD Coin, a stablecoin pegged to the U.S. dollar. Backed by $1 in reserve, cash and short-term U.S. Treasury bonds. Market cap: $55,733,671,155.

- BNB by Binance, the biggest cryptocurrency exchange globally based on daily trading volume. Market cap: $38,559,957,667.

Snapshot

- Bitcoin, the most popular with the largest market share. Maintaining and increasing value over time so it’s a safer long-term investment. At the time of writing, Bitcoin has the highest market cap at $408 billion.

Bottom line

Cryptocurrencies with a market cap of $10 billion and more, which is considered a large-cap, are generally thought to be a safer investment compared to small-cap cryptos which are more risky.

2. Why Market Cap IS Important?

It indicate growth potential and if it’s a safe buy, compared to others.

Overview

Investors use market cap to know more about a potential crypto investment and compare values to other cryptocurrencies. It can show a cryptocurrencies growth potential and if it’s safe to buy compared to others.

But cryptocurrencies can be volatile with the market cap changing alot.

Market cap is important as a metric for comparing the total value of cryptocurrencies, but consider market trends, a cryptocurrency’s stability, and your own financial situation before any investment.

Highlights

An example comparing two made up Cryptocurrencies:

- Cryptocurrency A: 400,000 coins in circulation worth $1 each. Market cap = $400,000.

- Cryptocurrency B: 100,000 coins in circulation worth $2 each. Market cap = $200,000.

- Note: Cryptocurrency B is higher than Cryptocurrency A but the overall value of Cryptocurrency A is double compared to Cryptocurrency B.

Snapshot

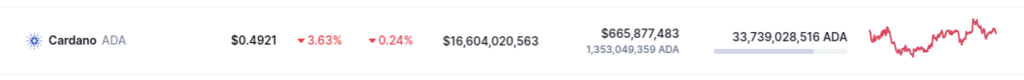

Cardano (ADA) is the best established large-cap penny Crypto. Ideal for people who want to start out small as its prices have been ranging between $0.4 and $1.60 for the past six months.

Bottom line

Investors use coin market cap to compare the value of cryptocurrencies. It can indicate the growth potential of a cryptocurrency and if it’s safe to buy, compared to others.

3. Why Market Cap is NOT Important?

Use Metcalfe’s Law, market liquidity & monthly volume metrics plus Market Cap.

Overview

Market caps being used to compare the value of cryptocurrency come with risks because locked up or lost crypto affect the real market cap of coins.

Around 4 million Bitcoins are lost on servers. So taking out the missing Bitcoins from the curculating supply shows its actual worth.

Sharks can mislead market capitalizations with smaller cryptocurrencies by holding on to alot of coins from the start then dumping them on the market at once, devaluing it.

Highlights

Some metrics to consider when comparing and evaluating cryptocurrencies:

- Metcalfe’s Law is the number of users on a Crypto trading network. Tracking this number represents network movement. Also remove users without any transactions.

- Note: Metcalfe’s Law is not incorruptible and can easily be gamed on networks with low transaction fees, meaning potentially less trading going on.

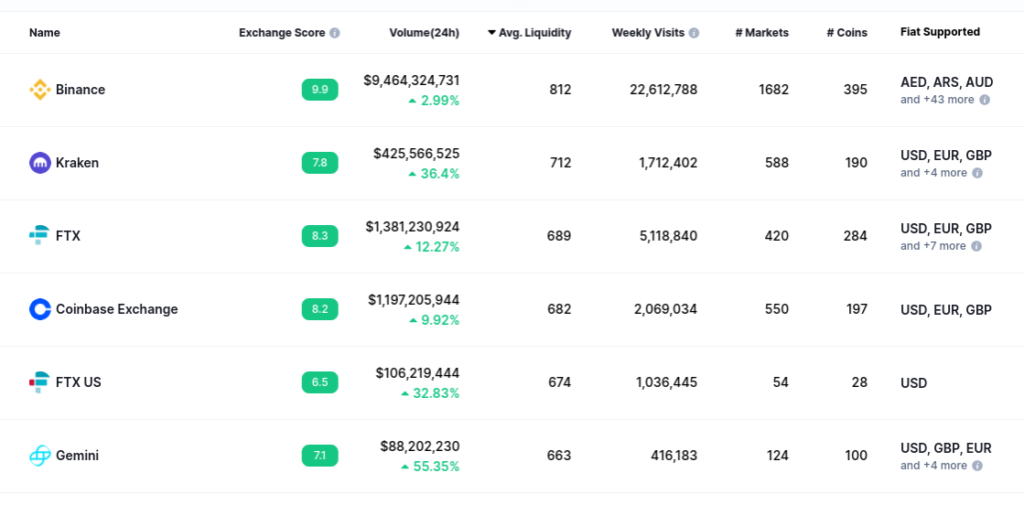

- Liquidity evaluates the trading going on in any Cryptocurrency. Lack of trading could represent sharks that dump their coins and create a drop in the market.

- Monthly Volumes and not watching daily volumes is a good idea. Daily volumes can be deceiving due to volatility.

- Note: Cryptocurrency is volatile. But an interesting and dynamic with a lot of opportunity and risks. Understand how it works and the risk of losing money.

Pricing

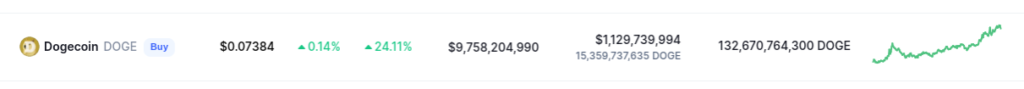

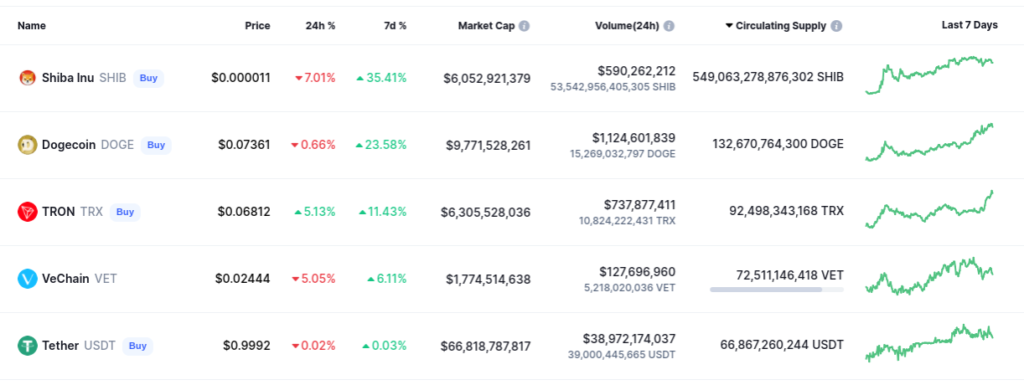

- An example of sharks misleading market cap with smaller crypto is Dogecoin (DOGE). No special use or features and unlimited supply. Previously being a fraction of a penny, in 2021 celebrity endorsements pushed its market cap to the top 10 in a few months, to roughly $0.70 before dropping below $0.20.

Bottom line

Using coin market cap alone as a metrics isnt enough. Consider Metcalfe’s Law, market liquidity, monthly volumes and market cap for a better picture on potential Crypto investments.

4. What happens when a Coin reaches Maximum Supply?

More earnings are made from transactions versus mining.

Overview

The maximum supply of a cryptocurrency is the maximum number of coins or tokens that will be created and no new coins will be mined or minted.

When the maximum supply is reached, there will be fewer coins on the market. Creating market scarcity, eventually leading to deflation or 0% inflation rates.

Some cryptos dont have a set maximum supply, always being mined or minted. Ethereum has no maximum supply, increasing with new blocks generated.

Highlights

Coins with no maximum supply:

- A limitless supply of ETHs (Ethereum), unlike Bitcoin. Releasing a fixed number of new coins each year. Mined at a constant rate of 18 million each year.

- USD Coin (USDC) is US money on the blockchain, sent instantly worldwide and providing stability to cryptocurrencies. For commerce, lending, and risk-hedging.

- Even though Dogecoin (DOGE) was created as a prank, its blockchain still has value. Litecoin technology underlies it. Employs script method, low price and infinite supply.

- DAI is the product of a transparent software called the Maker Protocol, a decentralized application running on top of the Ethereum platform.

- Monero, is a secure, privacy-focused and decentralized payment system. Achieved by obscuring the sender, receiver and the amount of every transfer made.

Pricing

- Ethereum has no limits on maximum supply. But Bitcoin has a max cap of 21 million. Over 120,426,128 ETH are in circulation as of April 2022.

Bottom line

After a crypto reaches max supply in circulation, it becomes more scarce and miners start earning more from transactions that happen on these blockchains than from the mining itself.

5. Is it better to invest in Large Cap or Small Cap Coins?

Large-cap Crypto investing is safe & small-cap is risky.

Overview

In the stock market, a company’s market capitalization is split into into three investment category: small cap, mid-cap, or large-cap. Investors can have different reasons to divide investments into these groups.

With the market capused to determine a companies worth, and risk of potential investment. Large-cap being less risky with slower growth than mid or small-cap assests.

Market cap in crypto allows you to compare the value of cryptocurrencies with eachother to make better investment decisions.

Highlights

Cryptocurrencies have three market cap categories:

- Large-cap Crypto: Coins with a market cap of more than $10 billion are considered low risk by investors based on growth track-record and higher liquidity. Higher cash outs don’t the price dramatically.

- Mid-cap Crypto: Coins with a market cap between $1 billion and $10 billion are considered to have untapped potential but also higher risk.

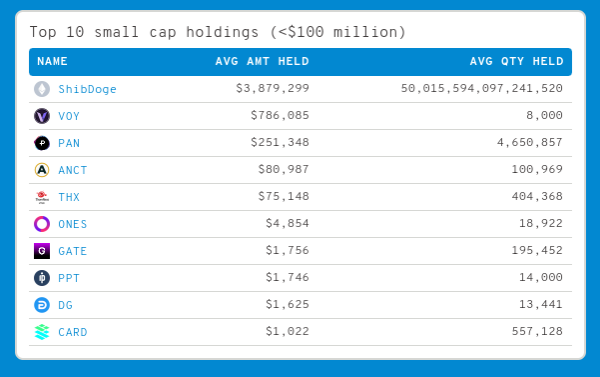

- Small-cap Crypto: Coins with a market cap of less than $1 billion have more risk because of dramatic price swings.

Pricing

- In April 2021, the Bitcoin market cap reached a record high of over 1,000 billion USD. At the time of writing, the market cap is at $408 billion, with each Bitcoin costing $21,435.

Bottom line

Small-cap crypto investments are riskier compared to large-cap. But have potential for better growth and better long-term returns and are more vulnerable to negative events and falling prices.

Which Crypto Website do I use?

Everyone needs a go to website for all their Crypto related content and mine is CoinMarketCap, offering market analysis, price charts, coins in circulation plus new and trending Cryptocurrencies and tokens.

With news and content, going in-depth into the data. Also an education section, ideal if you’re just starting out.

Wrap up

Coin Market capitalisation is a popular metric for Crypto investing. Other metrics help including volume, indicating market health with high volume giving traders confidence.

Supply is another, helping avoid ‘unit price bias’, which is when low token prices influence purchases. And price, which tells if the Cryptocurrency market is going up or down.