The biggest advantage of using accounting software is the time it saves. I have compiled a list of 5 best Microsoft Accounting Alternatives, so you save time choosing the right fit for your business.

The most important factor when choosing accounting software is who it’s built for. Some are for bigger businesses and others for small businesses.

Next consider the cost. Some charge monthly, others by usage of features whilst others are free so choose one that best fits your budget.

Then look at the features offered. Some offer a list of features that others don’t but are they for you?

What are the Best Microsoft Accounting Alternatives?

- Quickbooks – Ideal for those wanting a safe, tried and tested accounting option

- Freshbooks – Accounting software ideal for all types of businesses

- Sage – For self-employed, small businesses and accounting people.

- Wave – Accounting software for budget conscious newly started businesses

- Xero – Ideal accounting software for midsize to large businesses

1. Quickbooks

Ideal for those wanting a safe, tried and tested accounting option.

Overview

Quickbooks is a complete and competitive accounting software that’s easy-to-use and set up. Features include customer invoicing, mobile device access and recurring invoicing for services.

The add-on credit card service is integrated and simple to use, as is the add-on payroll. Sync to banks and credit cards to know the status of your bank accounts.

Monthly reconciliations are automated. Even import bulk invoices from a CSV to generate hundreds of invoices with a few clicks.

Allowing no compromise when switching from the desktop version with great reporting features it’s recommended to anyone with a small business.

Highlights

- Manage bills all in one place. Organize, track, and pay your business bills online.

- Expense tracking that saves time making it easy to track business expenses.

- Invoicing software for your business. Create and send invoices and get paid faster.

- Reporting in real-time to know where your business stands and plan what’s next.

- Tax deductions you deserve by ditching receipts and tracking potential deductions.

Pricing

Quickbooks has four pricing options:

- Simple Start: Start your business off right with basic bookkeeping – $12.50 Month

- Essentials: Automate your work to stay on top of business – $25 Month

- Plus: Manage projects, billing, and contractors, all in one place – $40 Month

- Advanced: Work smarter with the most comprehensive tools – $90 Month

Bottom line

Quickbooks is by far the better known accounting software, recommended for small businesses that want the confidence of using a popular tried and tested brand.

2. Freshbooks

Accounting software ideal for all types of businesses.

Overview

Freshbooks is easy-to-use for sending estimates/proposals to clients, tracking time on projects, and collecting payments.

With other features such as creating invoices, automatic expense capturing, and great customer service.

Connecting to your business bank account to reconcile all income and expenses, plus run detailed reports on the ins and outs of your money.

Automatically generate professional invoices allowing clients to pay through the payment portal with automatic payment reminders cutting out follow ups if you feel like you’re bothering people.

Freshbooks reduces the amount of time spent on administrative tasks, while making it easier for clients to pay.

Highlights

- Simple invoicing and billing so you save time to focus on doing what you love.

- Expense Tracking that’s simple and easy to track business expenses. Your spending and profits at a glance.

- Track your time to see how much you spend on client projects. Then invoice with just a click.

- Get Paid Faster by accepting online payments. Easier for clients to pay, which gets you paid faster.

- Work Anywhere with the mobile accounting app by staying connected with clients and taking care of your accounts.

Pricing

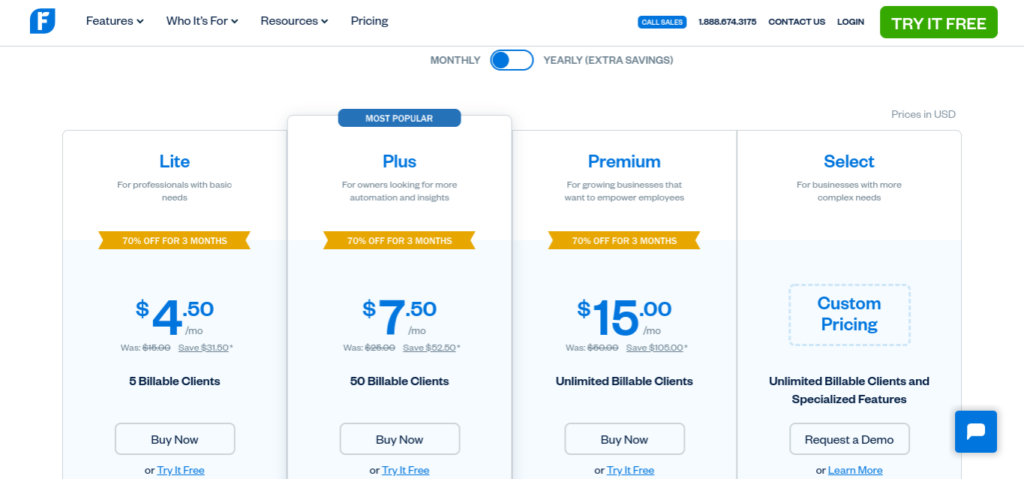

Freshbooks has four pricing options:

- Lite: For professionals with basic needs – $4.50 Month

- Plus: For owners looking for more automation and insights – $7.50 Month

- Premium: For growing businesses that want to empower employees – $15 Month

- Select: For businesses with more complex needs – Talk to sales

Bottom line

Freshbooks is the cheaper option for all types from freelancers, self-employed, businesses with contractors or businesses with employees and an accounting department.

3. Sage Accounting

For self-employed, small businesses and accounting people.

Overview

Sage Accounting is very affordable, easy to set up and ideal for users with no accounting experience. Data entry is easy and you can save time by simply syncing your bank accounts to Sage.

Allowing you to track invoices and pull necessary financial reports. Very secure with information backed up on the cloud and easily accessible makes Sage a comprehensive accounting system for small and medium businesses.

Highlights

- Easy automation saves you time and reduces errors with an intuitive process.

- Automatically send and track invoices making it easier to get paid on time.

- Securely connect your bank account to track your expenses automatically.

- Manage cash flow confidently by staying up-to-date on your accounts in real-time.

- Get paid faster every time with Stripe integration so your customers can pay easily.

Pricing

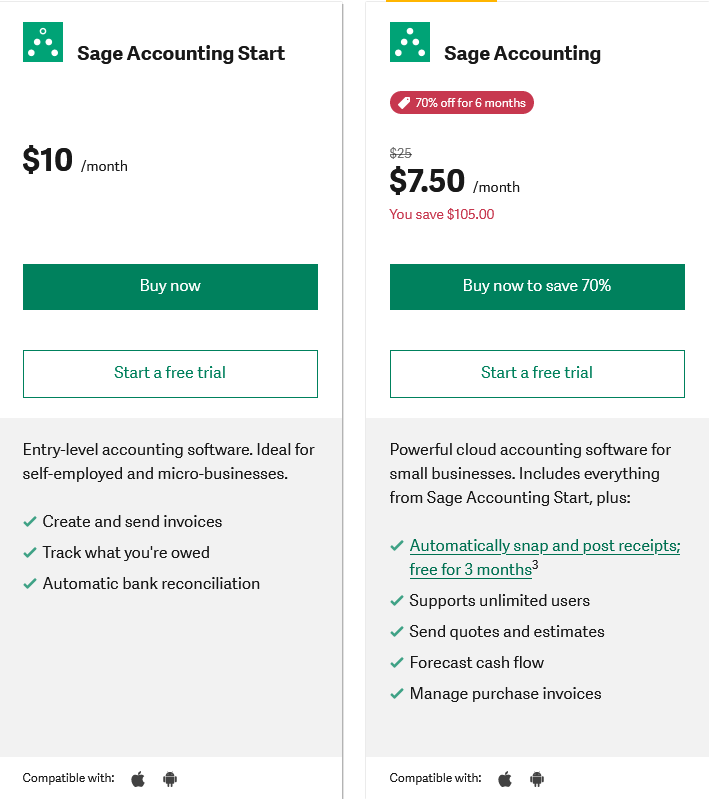

Sage Accounting has two pricing options:

- Sage Start: Entry level for self employed and micro businesses – $10 Month

- Sage Accounting: For small businesses – $7.50 User/Month

Bottom line

Sage Accounting is ideal for self-employed and micro businesses to small businesses and accountants or bookkeepers.

Wave

Accounting software for budget conscious newly started businesses

Overview

Wave is free to use for all your accounting needs and allows you to easily access reports to do taxes. Ideal for a small business just starting up.

Freelancers can use the invoice function to bill clients for hourly work. Automatically numbering invoices, keeping track of paid and unpaid invoices and has an easy set up to accept credit cards and bank payments.

Keeping track of income and expenses, whilst creating receipts to send when payments are received which are very polished and professional looking, along with invoices.

Wave can handle all your accounting and invoicing needs, recently moving into banking which makes life easier.

Highlights

- Tax time is simple when the smart dashboard organizes your income, expenses, payments, and invoices.

- Create invoices quickly and send professional invoices to your customers in seconds.

- Recurring billing for repeat customers by setting up recurring invoices and automatic credit card payments and stop chasing payments.

- Bookkeeping is already done as all invoicing and payment information automatically syncs with software included with your account.

- All customer information in one place so you’ll always know who you need to communicate with and about what.

Pricing

Wave has one pricing option:

- Accounting: No set-up fees, no hidden charges, no monthly fee – FREE

Bottom line

Wave is a free accounting software ideal for businesses that are just starting out or that have to keep a close eye on their budget.

Xero

Ideal accounting software for midsize to large businesses

Overview

Xero accounting software is very user-friendly for every type of person without the need for knowledge of accounting principles.

The user interface allows ease of navigation with the self-guided setup making it easy to launch and set up.

Other features include making banking integrations seamless and bookkeeping for taxes, done with the click of a button.

Helping make business accounting efficient and cutting down on the paperwork. Year end accounts are delivered easily with the ability to view everything in real time.

Making Xero powerful enough to handle both smaller and larger business needs.

Highlights

- Track and Pay bills on time. By getting a clear overview of accounts payable and cash flow.

- Claim expenses by capturing costs to submit for reimbursements, also view spending with expense manager tools.

- Get paid twice as fast by accepting payments online by connecting to Stripe, GoCardless and others.

- Track projects to quote, invoice and get paid for jobs whilst keeping track of costs and profits with the project and job tracker software.

- Use the payroll software to calculate pay and deductions, pay employees, and update accounts.

Pricing

Xero has three pricing options:

- Early: Good for sole traders, new businesses, and the self-employed – $12 Month

- Growing: Good for growing small businesses – $34 Month

- Established: Good for established businesses – $65 Month

Bottom line

Xero is a mid market accounting software when it comes to pricing but has the features to match and therefore is ideal for midsize to large businesses.

What is Accounting Software?

Accounting software streamlines repetitive business bookkeeping tasks, decreasing human errors previously with spreadsheets.

Used from accountants to small business owners to help process transactions, track expenses and automate accounting tasks to run a business.

Allowing users to gather all business accounting information in one place to summarise the financial situation.

That being said, the Microsoft accounting option is not the only choice, there are more flexible and affordable options out there.

Wrap up

With accounting software, don’t waste money on features you don’t need. Firstly consider features, is it for bookkeeping needs or a payroll system for 10+ employees.

Similarly when it comes to budget, have you just started your business and need to save every penny so you will go for the free option.

Although the Microsoft accounting option is one of the earliest softwares, as you can see from the alternatives it just takes a little research to uncover hidden gems out there.