Cryptocurrency or crypto is tradable virtual currency. Its not overseen or maintained by a central authority like a government or bank, making it decentralized and immune to government interference or manipulation.

Used as a digital means of exchange like physical money and built on blockchain technology with a network distributed across a large number of computers, recording and storing online transactions using encryption to authenticate and protect transactions.

To buy, sell and trade cryptocurrencies we need to use an exchange. Below are terms with simple explanations used on a crypto exchange to help you better understand the cryptocurrency marketplace platforms.

What are the 5 Crypto Terms you need to know?

- Wallet – Hardware cold storage wallets are more secure for storing Cryptocurrency compared to hot storage wallets.

- Volume – The more people trading a Crypto, the higher the volume and interest.

- Supply – The supply helps investors better understand the value of an assets along with a Crypto asset’s price.

- Market cap – Coin Market cap is used to tell more about a Crypto and compare its value with other Cryptocurrencies.

- Liquidity – High Cryptocurrency liquidity means a coin can be easily converted into cash or other coins.

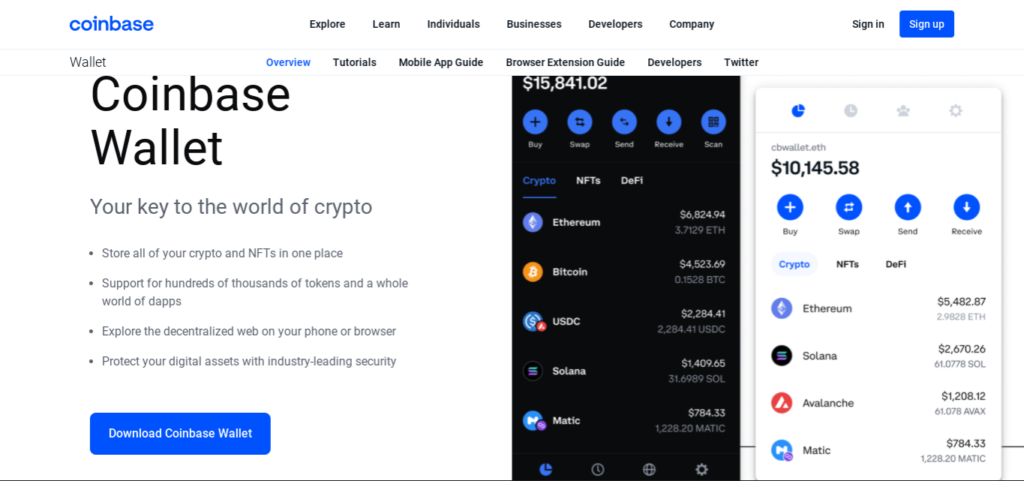

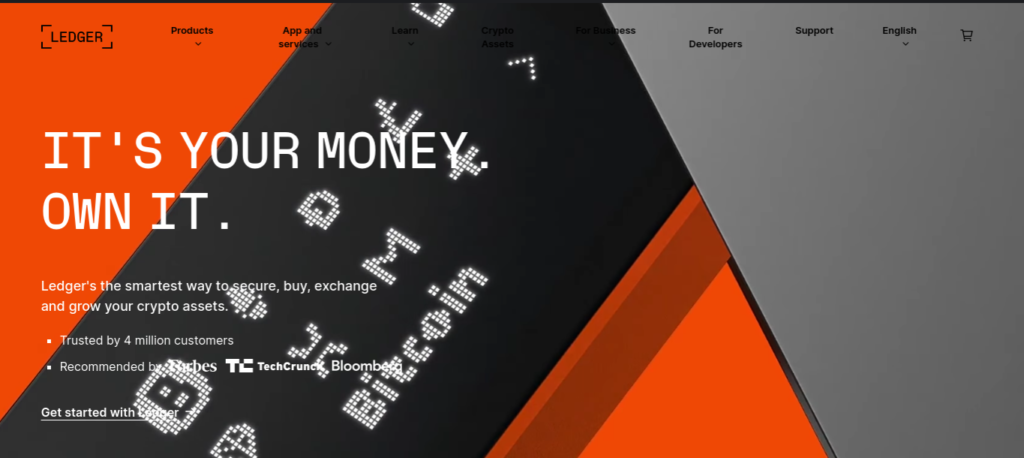

1. Crypto Wallet

Hardware cold storage wallets are more secure for storing Cryptocurrency compared to hot storage wallets.

Overview

Crypto wallets allows you to send, receive and store access information and digital assets securely on the bloackchain. Holding either one digital asset or multiple coins.

The types of wallets are online, mobile app and hardware based. Hardware wallets are physical devices and the most secure, containing cryptos private access keys.

Wallets can also be installed on PC or MAC desktops. Differences include hot wallets which connect to the internet and cold wallets which dont.

Highlights

- Coinbase wallet is for people getting started with bitcoin trading and doesn’t support non-bitcoin trading but it can store non-fungible tokens (NFTs) and digital collectibles.

- ZenGo supports Ether, Bitcoin and Binance Coin and uses credit cards or Apple Pay. Facial biometrics and encryption is used to protect your account.

- Mycelium is a Bitcoin-only wallet for novices and advanced users. Can be paired with hardware wallets. Private keys can be stored on a USB stick.

- Exodus features the standard set of mobile apps and supports over 145 cryptocurrency assets. Can be paired with hardware wallets.

- Ledger Nano S is an entry-level hardware wallet for casual crypto traders or as a secondary crypto wallet. Supports over 100 cryptocurrencies and over 1,000 tokens.

Snapshot

Hardware crypto wallets don’t require you to own any Cryptocurrency and usually cost between $100 and $200 but a lot of software-based wallets are free.

Bottom line

Hardware cold storage wallets are more secure for storing Cryptocurrency compared to hot storage wallets. If you’re storing a lot of coins or tokens for long, then go with a cold wallet.

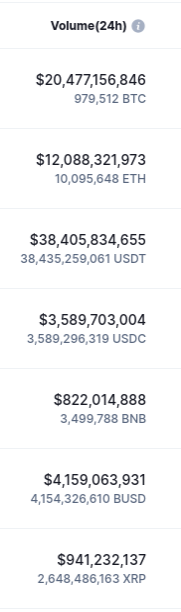

2. Volume

The more people trading a Crypto, the higher the volume and interest.

Overview

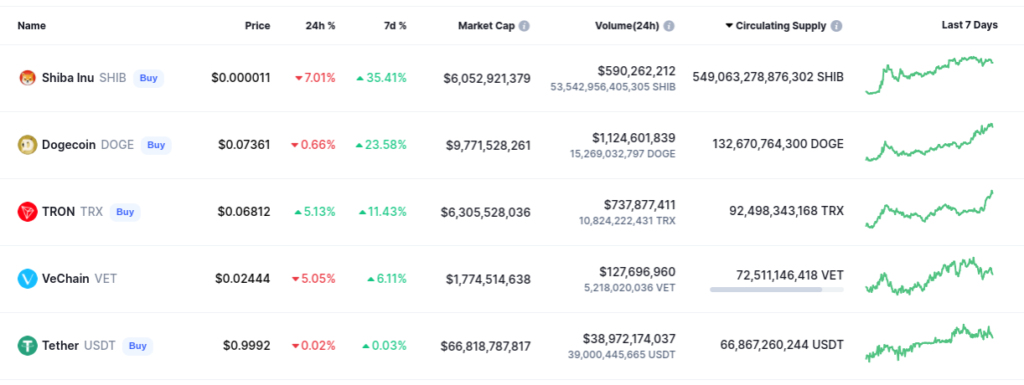

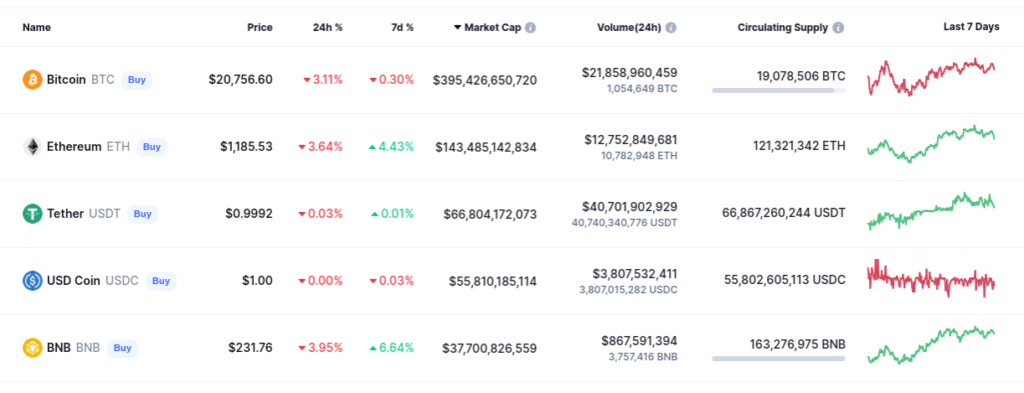

The top of Cryptocurrency charts have tabs labelled Volume, this is the total number of trades over 24 hours and help traders predict future profitability of cryptocurrencies.

High crypto volume means fairer pricing also meaning coins can easily be converted into cash or other coins.

Low crypto volume shows low trades because buyers dont want to pay the asking price. Also giving investors opportunities to buy low and sell high elsewhere, often called exchange arbitrage.

Highlights

- Tether is a stablecoin mirroring the price of the U.S. dollar, issued by a Hong Kong-based company. Volume: $49,189,666,727 / 49,223,044,002 USDT.

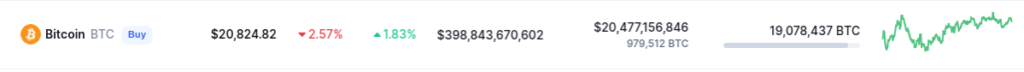

- Bitcoin, a decentralized cryptocurrency originally described in a 2008 whitepaper by the alias Satoshi Nakamoto. Volume: $27,750,642,283 / 1,327,825 BTC.

- Ethereum, a decentralized open-source blockchain system with its own crypto, Ether. Crypto and smart contracts. Volume: $16,996,576,836 / 14,196,268 ETH.

- USD Coin, a stablecoin pegged to the U.S. dollar. Backed by $1 in reserve, cash and short-term U.S. Treasury bonds. Volume: $5,212,570,872 / 5,210,897,566 USDC.

- Binance USD, a 1:1 USD-backed stable coin issued by Binance, Approved and regulated by NYDFS. Volume: $4,737,118,878 / 4,738,966,568 BUSD.

Snapshot

- The total Crypto Market volume at the time of writing is $64.30B. The total volume in DeFi is currently $6.12B. The volume of all stable coins is now $55.87B.

Bottom line

Volume shows interest in a Cryptocurrency. The more people trading a Crypto, the higher the volume and interest. Sudden increases in trading volumes means Crypto will go up or down.

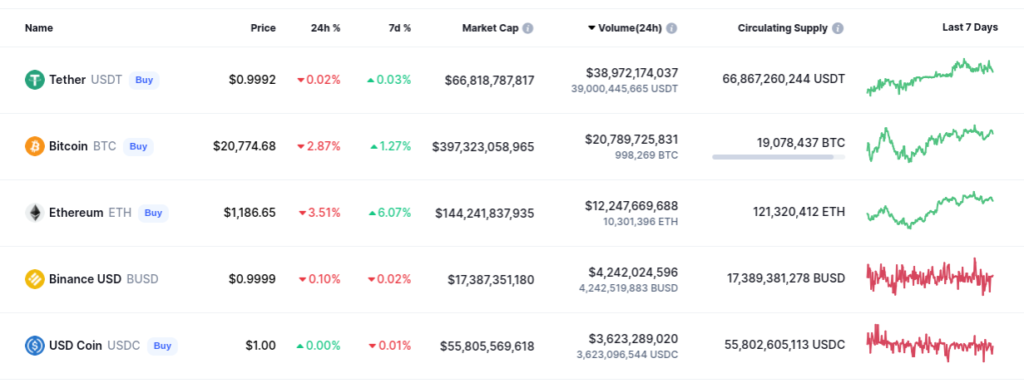

3. Supply

The supply helps investors better understand the value of an assets along with a Crypto asset’s price.

Overview

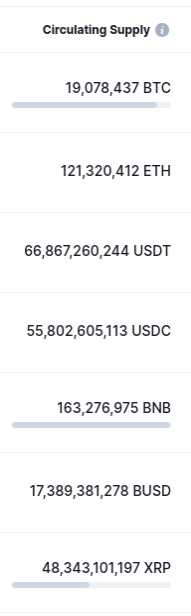

Circulating Supply is the number of cryptocurrency coins that are in the market and this can increase or decrease over time.

Supply can go up if its mined with new coins being created. And centralized token supply can increase with developers instantaneously minting.

Supply can go down by burning, sending to a receive only account and by accident, losing access to a wallet where funds are stored. So therefore circulating supply is just an approximation.

Highlights

- BitTorrent-New, a popular peer-to-peer file sharing and torrent platform which has become decentralized in recent years. Supply: 932,028,892,857,000 BTT.

- Shiba Inu, the “DOGECOIN KILLER” and listed on their own ShibaSwap. Created anonymously in August 2020 by “Ryoshi.” Supply: 549,063,278,876,302 SHIB.

- eCash, the rebranded version of Bitcoin Cash ABC. Aims to be a means of transaction used to pay for goods and services. Supply: 19,096,354,673,303 XEC.

- Holo, a peer-to-peer distributed platform for hosting decentralized applications built using Holochain, for developing DApps. Supply: 173,328,567,615 HOT.

- Dogecoin, the open-source digital currency created by Billy Markus and Jackson Palmer in December 2013. Supply: 132,670,764,300 DOGE.

Snapshot

- As of this writing, there are around 19.07 million BTC, 121 million Ethereum (ETH) and 66.9 billion Tether (USDT) coins in circulation.

Bottom line

The Circulating Supply is an important metric in the Crypto asset industry. The supply helps investors better understand the value of an assets along with a Crypto asset’s price.

4. Market Cap

Market cap is used to tell more about a crypto and compare its value with other cryptocurrencies.

Overview

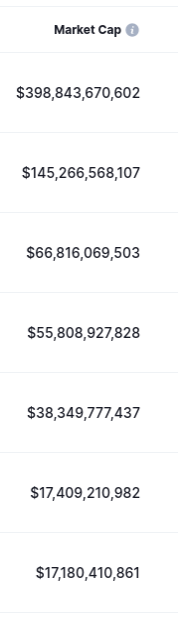

Market Capitalization or Market Cap is the total value when all of the coins are added up together.

Also calculated by multiplying a coin’s price by the number of coins in circulation. Used to determine the popularity of a crypto.

Market cap can be volatile like the price of a cryptocurrency, going up and down on an hourly basis. A large crypto cap of more than $10 billion is considered to be a safer investment.

Highlights

- Bitcoin, a decentralized cryptocurrency originally described in a 2008 whitepaper by the alias Satoshi Nakamoto. Market cap: $402,429,871,129.

- Ethereum, a decentralized open-source blockchain system with its own crypto, Ether. Crypto and smart contracts. Market cap: $146,090,477,163.

- Tether is a stablecoin mirroring the price of the U.S. dollar, issued by a Hong Kong-based company. Market cap: $66,928,550,682.

- USD Coin, a stablecoin pegged to the U.S. dollar. Backed by $1 in reserve, cash and short-term U.S. Treasury bonds. Market cap: $55,733,671,155.

- BNB by Binance, the biggest cryptocurrency exchange globally based on daily trading volume. Market cap: $38,559,957,667.

Snapshot

- At the time of writing the total Crypto Market capitalization has ranged from $1.19 trillion to $1.36 trillion.

Bottom line

Coin Market cap is used to tell more about a Crypto and compare its value with other Cryptocurrencies. It shows the growth potential and if it’s safe to buy, compared to others.

5. Liquidity

High Cryptocurrency liquidity means a coin can be easily converted into cash or other coins.

Overview

Liquidity of a cryptocurrency is how quickly and easily it can be traded and converted into cash without the value suffering and affecting the market price.

Increased liquidity helps avoid price distortions, shows how many users the platform has and which exchanges can trade between fiat and crypto instantly without price slippage.

A liquid cryptocurrency trades around its market price, is preferred by traders also increases if adoption and the use as mediums of exchange rises.

Highlights

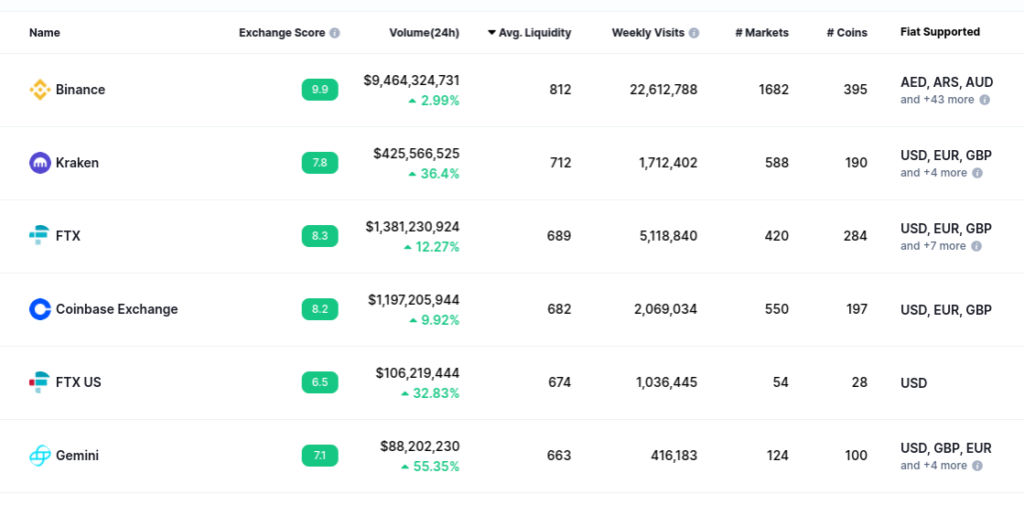

Best Crypto Exchanges based on liquidity:

- Coinbase/Coinbase Pro: Accepted currencies: U.S. dollars (USD), euros (EUR), Canadian dollars (CAD) and British pounds (GBP). Coins available: Hundreds including bitcoin (BTC), ethereum (ETH), litecoin (LTC), ripple (XRP), etc.

- Kraken: Accepted currencies: U.S. dollars (USD), euros (EUR), Canadian dollars (CAD), Australian dollars (AUD), etc. Coins available: Over 120, including bitcoin (BTC), ethereum (ETH), litecoin (LTC), etc.

- Gemini: Accepted currencies: U.S. dollars (USD), Australian dollars (AUD), Canadian dollars (CAD), euros (EUR), etc. Coins available: Over 75 coins, including bitcoin (BTC), ethereum (ETH), bitcoin cash (BCH), etc.

- Binance US: Accepted currencies: Binance.US accepts USD only. Coins available: Extensive list, including bitcoin (BTC), ethereum (ETH), litecoin (LTC), ripple (XRP), etc.

- FTX: Accepted currencies: U.S. dollars (USD), Australian dollars (AUD), Canadian dollars (CAD), Euros (EUR), etc. Coins available: More than 300 cryptocurrencies for spot trading, including Bitcoin (BTC), Ether (ETH), Solana (SOL), etc.

Snapspot

- Bitcoin, the world’s first and most actively traded digital asset, is often recognized as being the most liquid virtual currency.

Bottom line

High Cryptocurrency liquidity means a coin can be easily converted into cash or other coins. Low liquidity means that the market is volatile which causes spikes in Cryptocurrency prices.

What is a Crypto Exchange?

Exchanges are digital platforms for trading Cryptocurrencies for fiat money or other Cryptos.

Accepting card or other electronic payments, charging a fee for services and sending assets to consumer crypto wallets.

Types of Cryptocurrency exchanges are centralized, facilitating transactions between parties like Binance, and decentralized, peer-to-peer trading without central authority like IDEX.

Wrap up

Crypto investing is high risk with high rewards. Upsides include being secure on Blockchain technology, its a transparent financial system that trades 24/7.

Also coming with downsides so investors should be educated on both. Like Cryptocurrency investing takes time and effort, can be volatile with newbies getting scammed and losing money.